GAZPROM ADR SP./2 RL 5L 5

Commented by Stefan Feulner on September 16th, 2021 | 13:17 CEST

FuelCell Energy, Saturn Oil + Gas, Gazprom - The Renaissance of fossil fuels

There is no question that Germany has already achieved a great deal in terms of climate protection. In 2020, about 45% of its electricity came from renewable sources. However, the goal of becoming greenhouse gas neutral by 2045 is still a long way off. For this plan to become a reality, wind power still needs to be expanded significantly. The first half of the current year shows that it will not be possible to do without fossil fuels in the coming years. According to calculations by the Federal Statistical Office, over 56% of the total 258.9 billion kWh of electricity generated in Germany came from conventional sources such as coal, natural gas and nuclear energy.

ReadCommented by André Will-Laudien on September 13th, 2021 | 12:07 CEST

Gazprom, Barsele Minerals, Agnico-Eagle, Nordex - The energies of the future!

Election Sunday in Germany is approaching. No matter who will win the race at the end of September, the goals in climate policy have been put on the agenda by every party. In the future, it will not be possible to ignore this issue because young voters, in particular, are rightly concerned about the living conditions for the next generations. The decisive factor will be the course set in energy policy.

ReadCommented by Carsten Mainitz on September 7th, 2021 | 10:40 CEST

Deutsche Rohstoff, Gazprom, Royal Dutch Shell - Do you really want to miss out? Single-digit P/E ratios and share price gains!

Commodities giant BHP is selling its oil and gas business after more than 60 years. However, other companies are pushing to enter and expand in this sector. How does this fit together? Ultimately, it is strategic decisions - focus, diversification or transformation? The high prices for oil and gas are providing producers with high profits. The medium-term outlook is also good. Growth and a favorable valuation are thus enticing. These are the stocks worth taking a closer look at.

ReadCommented by Nico Popp on September 1st, 2021 | 10:39 CEST

Gazprom, Kodiak Copper, Nordex: This is how the energy transition pays off

Keeping the economy moving requires energy. This energy can come from a variety of sources. Fossil fuels, such as oil and gas, have come under fire for their CO2 emissions. However, what is clear is that these energy sources will remain important for a long time to come. As a climate-neutral alternative, electricity from renewable sources is gaining in importance. However, this requires investments in storage facilities and transmission lines. We present three stocks related to the energy sector.

ReadCommented by Carsten Mainitz on August 25th, 2021 | 12:02 CEST

Saturn Oil + Gas, Gazprom, K+S - Watch out: Single-digit P/E ratios here!

Several ratios exist to quickly understand whether a stock is cheap or expensive when analyzing stocks. The list of limitations why this is no more than a rule of thumb is long. The following companies with strong substance and good operating businesses are certified by analysts to have very low valuations with single-digit P/E ratios. Which stock has the greatest potential?

ReadCommented by Nico Popp on August 24th, 2021 | 12:46 CEST

Gazprom, Central African Gold, Steinhoff: Dynamic opportunities arise here

In July, German consumer prices rose by 3.8%, the highest rate in almost thirty years. The Deutsche Bundesbank expects inflation to climb to around 5% this year. Such a devaluation of capital naturally puts savers under pressure. In addition to the conservative to speculative investments in commodities, which often rise in step with inflation, some investors are also considering speculative gambler stocks. We present three shares and assess their suitability as inflation investments.

ReadCommented by André Will-Laudien on August 11th, 2021 | 11:16 CEST

Standard Lithium, Defense Metals, Gazprom - This bottleneck costs real money!

Electromobility is becoming increasingly important for the energy transition in transportation. And with it the research, development and production of batteries, especially in Germany as a high-tech location. In addition to performance, the sustainability of batteries plays a decisive role. In particular, this includes fair and sustainable sourcing of raw materials, a high proportion of renewable energies, and optimal energy efficiency in production. Completing the battery cycle would be intelligent reuse and a closed resource cycle through recycling. Some metals on this earth are extremely scarce and rarely occur in nature. They take on a strategic dimension in the context of climate protection.

ReadCommented by Armin Schulz on July 28th, 2021 | 12:03 CEST

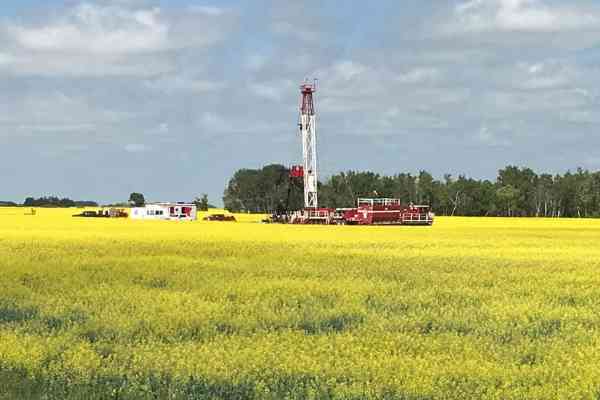

BP, Saturn Oil + Gas, Gazprom - Oil companies offer great opportunities

The oil price came under pressure in mid-July following an OPEC meeting. Starting in August, production will be increased by 400,000 barrels per day. This arrangement is to apply initially until September 2022. From May 2022, the United Arab Emirates, Kuwait, Iraq, Saudi Arabia and Russia all want to increase their production capacities, which would mean additional production of around 1.6 million barrels per day. The price of crude oil subsequently slumped by around USD 10 to USD 65. However, the downward trend was already broken on July 20, and the price has since climbed back up to USD 72. Today we highlight three companies that produce oil.

ReadCommented by Carsten Mainitz on July 16th, 2021 | 10:20 CEST

Gazprom, Desert Gold, Orocobre - Raw materials remain on course for growth

Raw materials are an important industrial commodity. If there are no raw materials, there are no industrial goods. When you think about this, it quickly becomes clear why commodities will always remain an important investment topic. Of course, there are phases in which some commodities are more attractive than others. The following three stocks can be used to take advantage of precisely this circumstance. Which stock has the greatest potential?

ReadCommented by Nico Popp on July 8th, 2021 | 12:33 CEST

Gazprom, Aztec Minerals, Steinhoff: Fast takeovers instead of lengthy procedures

Commodity investments are in demand, especially in times of sharply rising prices. Many investors focus exclusively on the big names. But there are also speculative second-line stocks that are suitable for investment. In the next few minutes, we will explain what investors need to watch out for and why penny stocks should not be exclusion criteria.

Read