TROILUS GOLD CORP. NEW

Commented by André Will-Laudien on November 5th, 2021 | 13:56 CET

TUI, Troilus Gold, Lufthansa - These are the turnaround stocks for 2022

If you think about interesting portfolio mixes today, you will find some lagging stocks on the price list alongside blockbuster shares such as Tesla, Apple & Co. There is still a lot of catching up in the travel industry, for example, and in financial stocks. The permissible question is, of course, whether there will be a real comeback to the "old world" for the travel industry after the extended COVID restrictions. Experts deny this hope, but there are huge restructuring and forward-looking cost-cutting measures in tourism stocks in particular. We take a look at some shares and examine the opportunities.

ReadCommented by André Will-Laudien on October 7th, 2021 | 13:38 CEST

Deutsche Telekom, Troilus Gold, Barrick Gold - Time for the safe haven

The world's stock markets are reeling. With inflation on the rise and investors fearing a turnaround in interest rates, the crash prophets are again coming out of their holes. Kiyosaki, Mr.DAX and Co. see themselves confirmed by an impending real-estate bankruptcy rolling towards us from China, triggered by the real estate Company Evergrande. Indeed, stock market barometers are in correction mode, at least in the short term, with the DAX tearing through the psychologically important 15,000-point mark. Meanwhile, another market is in the starting blocks to make a comeback.

ReadCommented by André Will-Laudien on October 1st, 2021 | 13:19 CEST

China Evergrande, Troilus Gold, Daimler, BP - With quality against the crash!

In strongly fluctuating markets, good advice is expensive. China Evergrande has divested itself of a bank stake in order to refinance its obligations. Some will say this is already getting down to the wire. China's real estate markets appear to be in serious trouble. We hear little about the default payments to foreign investors, and domestic investors have probably received their interest late. Everything is in the balance here. Meanwhile, the Bund future falls below the critical 170 mark, which means that the European bond markets also suffer from a slight withdrawal of confidence. We look at some standard stocks with high content.

ReadCommented by Carsten Mainitz on September 24th, 2021 | 12:09 CEST

Troilus Gold, Rio Tinto, BHP - Exploit uncertainty!

The falling demand for iron ore by the world's largest consumer, China, has put enormous pressure on the prices for iron ore and led to the downward slide in the share prices of major players such as Rio Tinto and BHP. In the medium term, prices will have to rise again due to high demand. Likewise, precious metals should rise in times of high inflation, including copper, which is in demand due to the growth of electromobility, among other things.

ReadCommented by Stefan Feulner on September 13th, 2021 | 13:43 CEST

Xiaomi, Troilus Gold, Merck - First-class developments

Substantial gains were recently seen in consumer and producer prices in Germany and Europe. Inflation in Germany reached its highest level in almost 28 years in August and is close to breaking through the 4% mark. In contrast to central banks, which consider the rate of inflation to be temporary and continue to maintain an ultra-loose monetary policy with interest rates at zero percent, economists expect inflation to remain permanently high. There is a threat of a decline in the value of money, which could be slowed down by buying gold. Currently, the precious metal is still trading at a favorable level.

ReadCommented by Nico Popp on September 2nd, 2021 | 12:15 CEST

Heidelberger Druckmaschinen, Troilus Gold, TUI: The Power of Transformation

Transformations are the salt in the soup of the stock market. Whenever companies break new ground, win new customers or enter completely new territory, opportunities arise for investors. At the beginning of such developments, the market usually does not quite believe in the chances. But then, more and more investors jump on the bandwagon and boost the share price. The further transformations go, the greater the associated opportunities. We present three companies that are breaking new ground and classify their prospects.

ReadCommented by Stefan Feulner on August 23rd, 2021 | 10:20 CEST

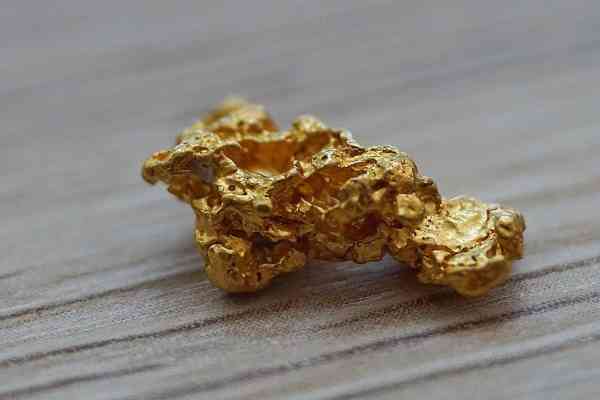

Palantir, Troilus Gold, Nikola - Protection from black swans

Discussions to end the ultra-loose monetary policy of both the FED and the ECB and a reduction in monthly bond purchases are currently in full swing. Fears of possible interest rate hikes due to rising inflation recently sent the gold price into flash crash mode. In the process, the precious metal lost more than USD 100 per ounce overnight and stopped short of marking a new low for the year. Since then, the crisis currency has stabilized again and could generate a new buy signal in the short term. In the long-term, gold is likely to shine brightly again due to the current framework data.

ReadCommented by André Will-Laudien on August 20th, 2021 | 13:28 CEST

TUI, Troilus Gold, Lufthansa - The golden summer of travel!

The "Second Summer with Corona" has seen a resurgence in international travel, even though not all corners of the globe have returned to pre-pandemic levels. At least, however, the lockdowns have largely disappeared, restaurants are open again, and cultural life is gradually returning. The travel industry is experiencing this period in different ways. For example, first, there were problems with the allotments due to many hotel bankruptcies, but then these were increased at short notice and ultimately, special promotions had to be called to sell them off. In the end, price increases could not be implemented. People's travel behavior is changing in the long term, as is society as a whole. The travel industry is, therefore, seemingly only at the beginning of a far-reaching structural change.

ReadCommented by Carsten Mainitz on August 10th, 2021 | 14:29 CEST

Troilus Gold, Barrick Gold, Vonovia - Where does the correction offer the greatest opportunities?

Good US labor market data have made voices for an exit from the extremely loose monetary policy of the US Federal Reserve louder again. As a result, the US dollar strengthened and the prices of gold and silver weakened. From a chart perspective, prices of around USD 1680 for gold appear realistic in the short term, accompanied by high volatility. Such setbacks offer good trading and investment opportunities in first-class gold stocks. Who is ahead?

ReadCommented by Stefan Feulner on August 5th, 2021 | 13:41 CEST

Commerzbank, Troilus Gold, Allianz - The bubble bursts!

Rising consumer prices are belatedly arriving in Germany. At 3.8%, these were higher in July than at any time since the fall of 2018. And inflation is also likely to pick up further due to rising commodity prices. Instead of raising interest rates and reducing bond runs, the European Central Bank sticks to its ultra-loose monetary policy. The high rates of price increases are said to be temporary and due to special factors. What to do as a saver when expropriation threatens? Take precautions against the worst-case scenario.

Read