KODIAK COPPER CORP.

Commented by Stefan Feulner on June 30th, 2021 | 11:12 CEST

JinkoSolar, Kodiak Copper, BASF - Caution: This market will explode!

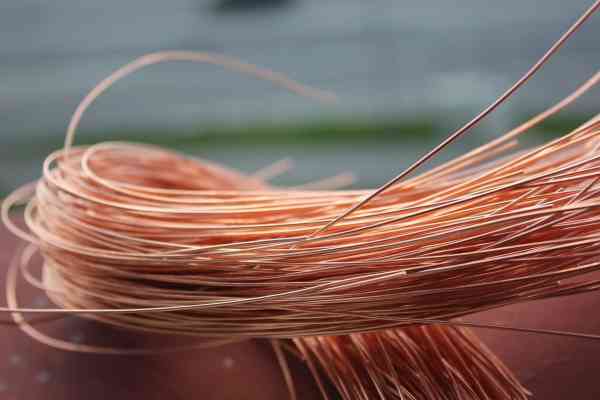

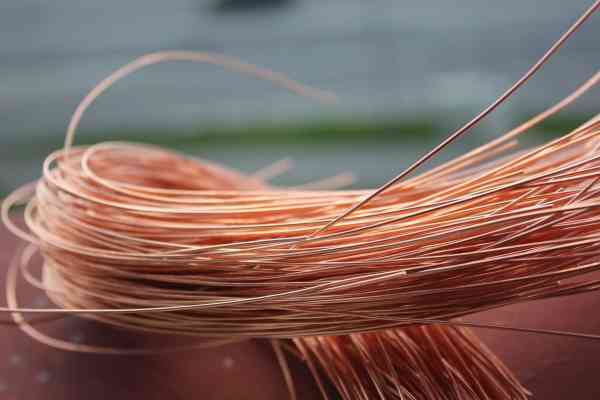

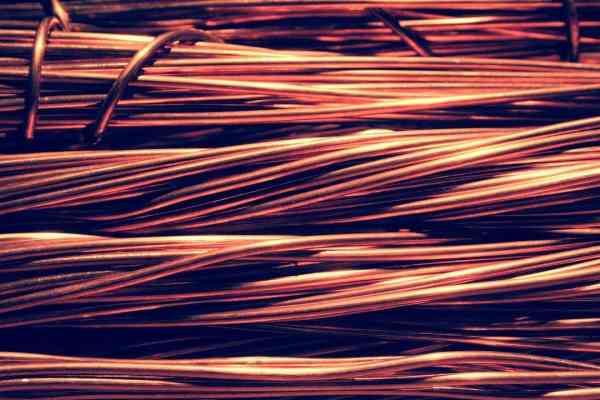

Due to the energy transition, the raw materials sector is undergoing a historic upheaval. Due to a CO2 reduction in the economy and transport, coal, gas and crude oil will lose importance in the future. The demand for metals such as copper will increase exorbitantly in order to expand the capacities for the generation and storage of renewable energies. Copper is and will remain irreplaceable in the electrification of the global economy due to its chemical properties. In 2020, the supply deficit rose to 560,000 metric tons, the highest in a decade. And transportation electrification is just getting started.

ReadCommented by Armin Schulz on June 18th, 2021 | 12:33 CEST

Kodiak Copper, Deutsche Telekom, Varta - What is going on in commodities?

The hype around wood lasted until May 25, after which the rally ended and the price consolidated by a whopping 40%. Gold was trading above USD 1,900 last week. In parallel to this article's writing, the price is below USD 1,800. A minus of about 5.5% within five days, and the industrial metal for electrification and copper, dropped by 8%. Currently, all factors speak for a further increase in commodity prices. Real interest rates are still negative, and inflation should also remain high. The Fed could not help calm the markets, although interest rate hikes were not announced until 2023. However, the Fed intends to continue its bond purchases. Consolidation can always occur after strong increases, and so we will see long-term rising commodity prices, especially for precious metals and copper.

ReadCommented by André Will-Laudien on June 9th, 2021 | 10:41 CEST

BYD, Nordex, Kodiak Copper: The green revolution!

They have not yet been seen in the state elections of Saxony-Anhalt! However, the political green wave in Germany is starting to warm up for the federal election. Consumers expect greater awareness of the Paris Climate Agreement with corresponding measures in our country, especially in Europe. Already today, this is getting investors to focus correctly on the issues of the future. In plain language, this means continued tax incentives of the highest magnitude for so-called "environmentally friendly technologies" that include solar plants and wind power, including, above all, battery-powered mobility and hybrid vehicles. We shed light on some of the favorite stocks.

ReadCommented by Carsten Mainitz on May 31st, 2021 | 11:45 CEST

BYD, Kodiak Copper, Xiaomi - Copper: Buy or cash in?

The demand for copper will continue to grow. These are the findings of the recently published study by the International Copper Association (ICA). The ICA predicts that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors. But copper is also in demand in many other industries. Demand exceeding supply or supply bottlenecks can make the raw material more expensive overnight at any time. For this reason, today, we take a look at a budding copper producer. Of course, large demanders such as BYD or Xiaomi must not be missing in the consideration. After all, our everyday companion, the smartphone, contains 15% copper. Let us surprise you with three exciting investment ideas.

ReadCommented by Nico Popp on May 27th, 2021 | 07:50 CEST

Kodiak Copper, ThyssenKrupp, BYD: Three trends in one share

Copper is the metal of the moment. There are several reasons in favor of copper. Firstly, copper is benefiting from the global economic recovery following the end of the pandemic. The industrial metal has always been the primary beneficiary when infrastructure is invested in or otherwise built. It is precisely in this way that countries want to boost their economies after the pandemic. At the same time, there is a dynamic demand from the e-car industry. E-cars and charging infrastructure, none of that works without copper. And last but not least, inflation is getting to us - the Bundesbank is already expecting inflation rates beyond the 4% mark. Again, commodity prices tend to benefit.

ReadCommented by Stefan Feulner on May 20th, 2021 | 09:24 CEST

XPeng, Kodiak Copper, NIO - Megatrend scarcity

Bitcoin, Etherum and the entire crypto family are rushing into the basement. The reason for this is once again the Middle Kingdom. After a statement by the Chinese central bank that one may not use digital currencies for payment purposes, they lost more than 20% in value yesterday. China's market power is even greater when it comes to raw materials for the energy transition. Due to the scarcity of the corresponding metals, prices will rise enormously in the long term. Producers who offer alternatives in the Western industrialized countries can profit significantly from this.

ReadCommented by Armin Schulz on May 7th, 2021 | 13:11 CEST

Kodiak Copper, BASF, Varta - Copper study ignored

The International Copper Study Group (ICSG) sees a slight oversupply of the copper market in 2021 and 2022. The main reason for this is said to be dwindling Chinese demand. The demand is decreasing because China is expanding mine production and copper refining by about 3% each. After the study's publication, the price per ton of copper rose again to over USD 10,000. Possibly driven by the news from Chile, which produced 2.2% less copper than last year. Similar news can be heard from other major copper producing countries such as Peru. Copper concentrate supply is low at the moment. We, therefore, look at one copper explorer, one copper producer and one consumer.

ReadCommented by André Will-Laudien on May 2nd, 2021 | 19:04 CEST

BYD, NIO, Varta, Kodiak Copper: No e-mobility without copper!

The copper price is just about to climb the USD 10,000 mark. For many market participants, the scenario for the industrial metal is set. Because since the public declaration of the automotive industry to make the e-vehicle the No. 1 means of transportation, the demand for copper and battery metals is shooting through the roof. Mine operators worldwide are alarmed, but how do you increase capacity in the short term when there are too few developed projects? We dive into the market.

ReadCommented by Nico Popp on April 21st, 2021 | 09:19 CEST

NEL, Varta, Kodiak Copper: The market has missed this news

The mobility revolution is real. Last year, stocks like NEL sparked hydrogen fantasy among investors, but battery-powered electromobility will come back into focus in 2022. The reason: Companies such as Volkswagen and Daimler are increasingly committing to electromobility. And that opens up opportunities. We present three stocks.

ReadCommented by Carsten Mainitz on April 7th, 2021 | 09:30 CEST

BYD, Kodiak Copper, Varta - Buying rate?

Electromobility, energy and digitalization are continuing as a trend. Even if some prices have run hot in the meantime, the current price consolidation offers tempting entry opportunities. With the three shares presented, investors can bet on different facets of the trend. Which stock offers the most significant potential?

Read