EDGEMONT GOLD CORP. O.N.

Commented by Juliane Zielonka on May 19th, 2022 | 11:14 CEST

Amazon, Edgemont Gold, Valneva - The real gold wins

Only 'cash is king' seems to be the motto of this stock market week. High inflation is bringing tech stocks to their knees, and heavy artillery is also being brought to bear on Valneva's dead vaccine development front. The EU Commission wants to cancel the preliminary contract if the vaccine is not finally delivered within a month. Depth is also to be expected at Edgemont Gold, only this time, good things are hidden there. The gold exploration company is getting promising results from its third drill hole.

ReadCommented by Armin Schulz on May 6th, 2022 | 10:43 CEST

Barrick Gold, Edgemont Gold, Rio Tinto - Are gold stocks taking off again?

With the start of the Ukraine crisis, the gold price skyrocketed, but since March 8, we find ourselves in a consolidation. The 200-day line is currently holding, and it could go up again from here. But let's look at the reasons for the weakness in the gold price. On the one hand, there is the strong dollar, which naturally puts pressure on the gold price, and on the other hand, bond yields in the US are climbing again. After the FED announced on May 4 that it would not raise interest rates by more than 0.5 percentage points, which was originally feared, the gold price jumped again. Demand for physical gold remains high. We look at three companies in the gold sector.

ReadCommented by Carsten Mainitz on April 25th, 2022 | 13:22 CEST

Mutares, Edgemont Gold, Barrick Gold - Inflation soon to exceed 10%! What to do?

According to some experts, inflation could soon rise above 10%. The possible reaction of the central banks by increasing interest rates to contain inflation remains theoretical so far. After all, can the world's so heavily indebted countries afford significantly higher interest rates at all, and wouldn't a higher interest rate level stifle the economy? The bottom line is that a prolonged period of high inflation is very likely. Investors can effectively position themselves against the loss in value of their assets by investing in tangible assets. That means stocks, bonds, real estate and commodities belong in the portfolio!

ReadCommented by Nico Popp on April 20th, 2022 | 10:29 CEST

The million-dollar opportunity: Valneva, Edgemont Gold, BASF

No one can see into the future. But investors can estimate which topics will move share prices in the near future. There is not always a connection between what is important and what is played out in the media. Issues such as climate change are timeless but disappear from the front pages from time to time. It is currently a similar situation with the pandemic. We dare to take a look into the future and ask what could move prices this summer.

ReadCommented by Stefan Feulner on April 11th, 2022 | 19:03 CEST

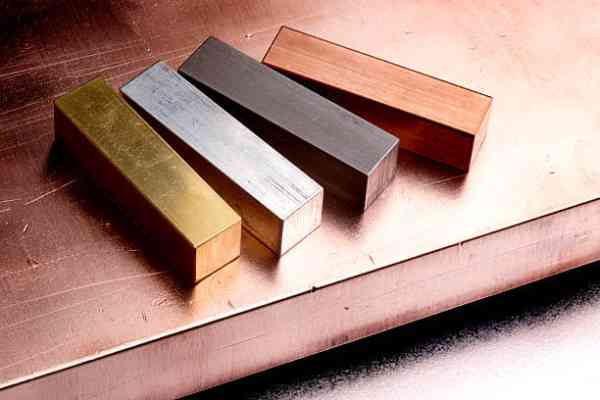

K+S, Edgemont Gold, NIO - Shares as protection against demonetization

Inflation rates have been rising steadily since the end of 2020. What was initially declared by central bankers as a temporary event is becoming a permanent problem for society and the economy. The loose monetary policy, the shortage of raw materials, and the blown-up supply chains were responsible for the fact that the inflation rate in the USA was 7.9% in March, the highest since 1982. As a result of the sanctions imposed on Russia, the supply of raw materials and oil and gas is becoming even tighter, causing prices to shoot up once again. Investors can protect themselves by investing in producers of scarce commodities. In addition, for diversification, gold should not be missing in any portfolio as protection against currency devaluation.

ReadCommented by André Will-Laudien on March 30th, 2022 | 11:36 CEST

Attention: BYD, Edgemont Gold, Delivery Hero, MorphoSys - Shares with the highest dynamics!

The intensity of fluctuation on the capital markets remains high. It is measured by volatility indices such as the EU Vola Index or the VIX on the S&P 500. Both indices had risen well above 30 at the beginning of the crisis, with the EU Vola Index even reaching a peak of 43.3% on March 7. At the beginning of the Corona Lockdown in February 2020, this index rose overnight to values of over 70%. Although these volatility coefficients are slowly trending downwards due to political easing tendencies, hedgers on the derivatives markets are pricing volatility into their products at a higher price. So those who are currently trading options may experience their blue miracle with Vola changes overnight. Some stocks have recently jumped in this environment; where are the opportunities?

Read